Using Big Data Analytics to Determine Next Best Action

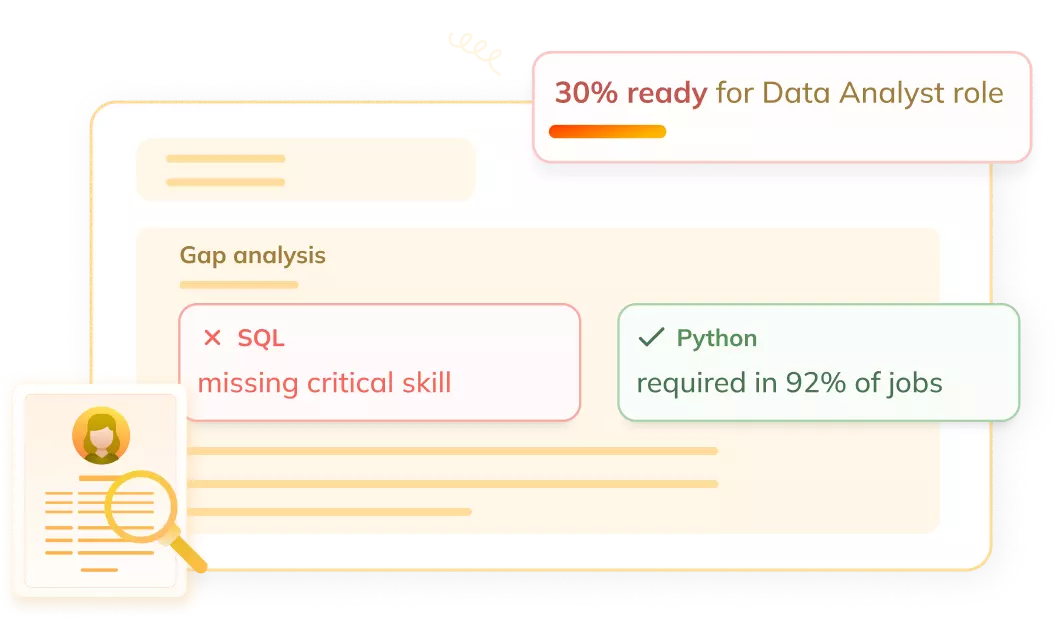

When it comes to deciding how to communicate with a service provider, the consumer is now in the driver's seat. This is true in a variety of businesses, including telecommunications, insurance, banking, and retail. The buyer now has a plethora of channel possibilities and is increasingly conducting research and making purchases via a mobile device. To compete in a fast-paced, mobile-driven industry, you must manage your customer interactions with in-depth and tailored knowledge about each unique consumer.

What does it take to provide a buyer with the best offer possible while he is considering his options? How can you ensure that your customer care professionals have specialized knowledge of your customer's importance to the company and her unique needs? How can you integrate and evaluate multiple sources of structured and unstructured data so that you can recommend the best course of action to clients at the time of engagement? How can you quickly measure a customer's worth and identify what kind of offer that customer needs in order to keep them happy and create a sale?

In highly competitive contexts, executives are increasingly seeing big data analytics as the secret weapon they need to take the next best step. When dealing with the rising pressures of an empowered consumer, using analytics to understand client expectations on a more personal level is viewed as a critical competence. Companies are increasing their usage of social media and mobile computing environments, and they want to reach out to their customers on their preferred channel at the correct moment. In a mobile world, offerings must be as targeted and personalized as possible to achieve good client outcomes. Companies are gaining a competitive advantage by combining their analytics platform with big data analysis and real-time data processing.

You can also consider our Data Analytics Course to give your career an edge over others.

Preventing Fraud with Big Data Analytics

According to some estimates, at least 10% of insurance company payouts are for fraudulent claims, and the total amount of these fraudulent payments is in the billions or trillions of dollars. While insurance fraud is not a new issue, the severity of the problem is growing, and insurance fraud perpetrators are becoming more skilled. All kinds of insurance, including automotive, health, workers' compensation, disability, and commercial insurance, are vulnerable to fraud. An individual who falsifies a broken arm claim after staging a fall at a shopping mall, or any number of company workers involved in the process of fixing damage from accidents, treating medical injuries, or dealing with other areas of the claims process, may conduct fraud. Insurance fraud is a common occurrence, and it may involve organized crime groups participating in auto repairs, medical treatment, legal work, home repairs, or other claim-related functions.

What role does big data analytics play in assisting insurance companies in detecting fraud? Insurance firms strive to prevent fraud before they get engaged in claim processing. Companies are better positioned to identify potentially fraudulent claims in the early stages of engagement by establishing predictive models based on both historical and real-time data on wages, medical claims, legal expenses, demographics, weather data, call center notes, and voice recordings. A falsified medical claim or a manufactured accident, for example, could be part of a personal injury claim. The number of sophisticated crime rings committing vehicle insurance or medical fraud has increased, according to businesses. These rings might use similar techniques of operation in different parts of the country, or they might use different aliases for claimants. Before the process gets too far along, big data analysis can immediately look for patterns in prior claims, discover parallels, and raise doubts about a new claim.

The Business Benefits of Integrating New Sources of Data

Big data analytics is giving businesses a new approach to solve certain long-standing problems. Traditionally, businesses have focused on ways to improve customer service, make the appropriate offer to the right consumer at the right time, and reduce risk and fraud.

So, what's different now? Companies can look at their businesses in new ways by combining new sources of unstructured data, including weblogs, contact center notes, e-mails, log data, and geographic data with traditional sources of the transaction, customer, and operational data. They can collect data that they couldn't before and utilize it to look for patterns of activity that provide them valuable insight into the organization. Integrating all of these data sources allows businesses to have a better understanding of their consumers, goods, and risk.

FAQs

What is big data in business analytics?

Big data analytics uses advanced analytic techniques for very large, heterogeneous data sets, which can contain structured, semi-structured, and unstructured data, as well as data from many sources and sizes ranging from terabytes to zettabytes.

What is big data used for in business?

Big data analytics systems that employ these disciplines aid firms in better understanding customers, identifying operational issues, detecting fraudulent transactions, and managing supply chains, among other things.

How does big data help business data analytics?

Every business, no matter how big or little, requires useful data and insights. When it comes to gaining a better understanding of your target audience and client preferences, big data is crucial. It even assists you in anticipating their requirements. The right data must be presented and analyzed in an efficient manner.

Key Takeaways

In this article, we have discussed the following topics:

- Big data helps in improving customer experience

- Detecting the next best action using big data analysis

- Preventing fraud with big data analysis

Happy Coding!